Cash Flow is King with April Features in QuickBooks Online

At Certum Solutions, our clients continuously reach out to ask about how they can improve their cash flow.

When this happens, we meet with them to help them understand their numbers in QuickBooks Online and QuickBooks Enterprise—because debits and credits in your QuickBooks file are not indicators of cash flow.

Why is cash flow important? According to Investopedia, “Positive cash flow indicates that a company's liquid assets are increasing. This enables it to settle debts, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges. Negative cash flow indicates that a company's liquid assets are decreasing.”

The new features in QuickBooks Online in April are designed to help you improve your cash flow through two products.

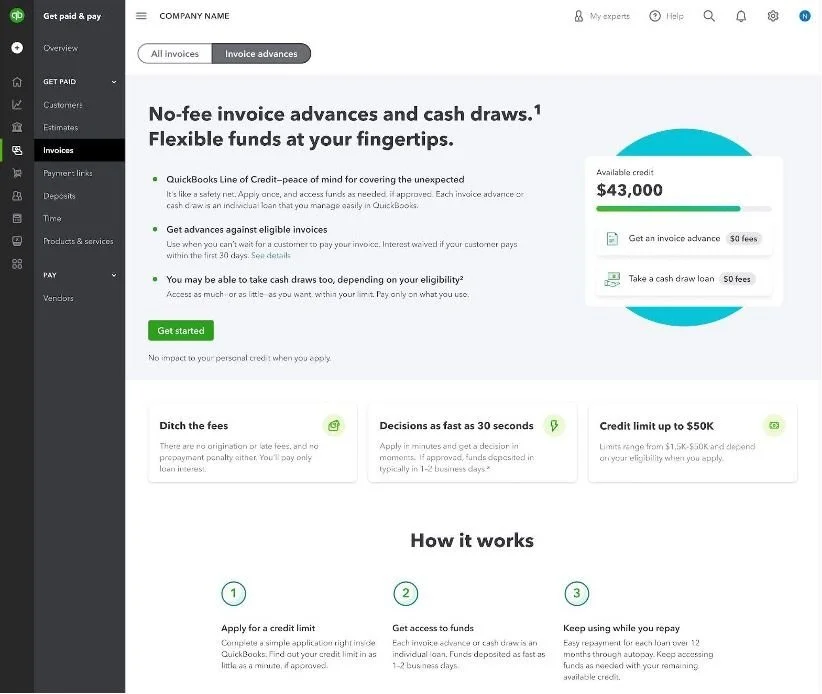

QuickBooks Line of Credit

For a number of reasons, it’s rare to find a business that doesn’t need access to extra cash, so take a look at the QuickBooks Line of Credit (previously called Get Paid Upfront) for the short term.

With the line of credit, you can cover bills and payroll, and is also helpful if you need to receive an advance on invoices by drawing cash from your available credit limit.

Credit limits range from $1,000 to $50,000 and you can apply inside QuickBooks. If you help locating this, please let us know. Once approved—just like most other lines of credit—you can decide when you want to use it and how you want to use it. According to QuickBooks, you’ll only pay for what you borrow, with no additional origination or draw fees and no prepayment penalties. As usually, interest will apply.

Operating Your Business: Certum can Help

Working with businesses in various industries to help owners understand cash flow—and how to operate their companies—is what we do best at Certum. Whether you work in construction, manufacturing, nonprofit, or something else, we can guide you to the best-fit product and service solutions.

Every business is different and there are no cookie-cutter solutions. Contact us today to learn more about our services.