QuickBooks Online Sprinkles in April Updates

Instead of April showers, we’re getting a sprinkling of updates to QuickBooks Online Advanced and QuickBooks Payroll. No matter how small, we’re always happy to see changes that make running business easier.

This month, there are new simple options for creating comparison visualizations, an easier way to run payroll when you employ union members, and a compelling reason to switch to QuickBooks Online Advanced and Shopify’s point of sale.

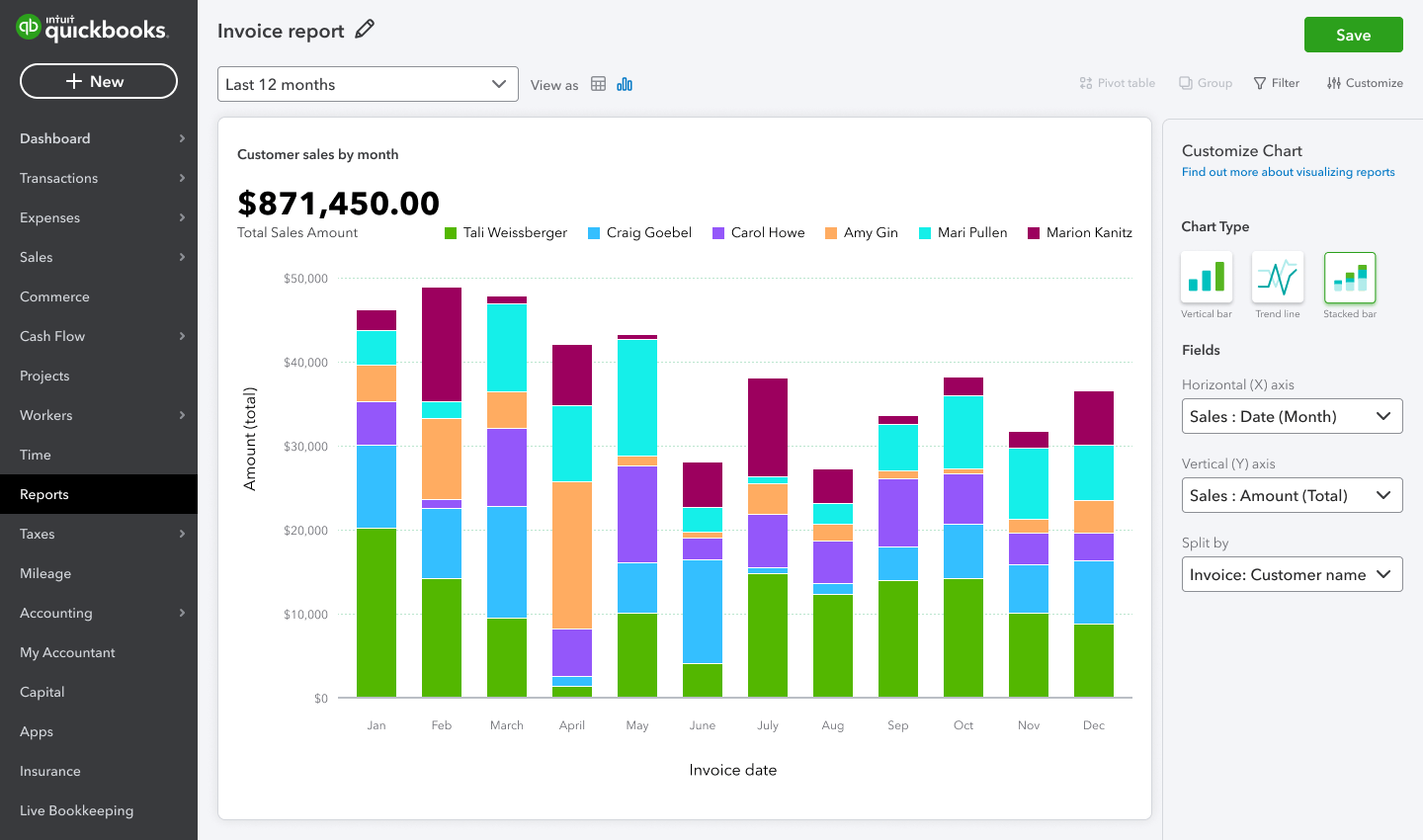

Create comparison charts

For users of QuickBooks Online Advanced, a trio of charts for comparisons has been added to the Custom Report Builder. The new charts let you easily compare data without leaving the program or pulling a muscle to get a side-by-side view of your data sets. You can pull in data from up to 27 fields for your chart to look at things like customers, products, and locations.

View your data in one of three ways:

● A trend line chart to compare changes over time, such as the relationship between time worked and total sales over a month.

● A vertical bar chart to compare like things, such as gross sales by employee for the quarter.

● A stacked bar chart to compare portions of a whole, such as an annual review of monthly revenue broken down by customer.

Automate payroll for union members

Business owners who take care of employees’ paychecks through QuickBooks Payroll can automate another finicky step in the process. Figuring the deductions, like union dues, and contributions for employees who are union members can be a tedious manual process. With this update, QuickBooks Payroll calculates the amounts for you based on an employee’s hours worked, salary, commission, overtime, or double overtime.

Go to the employee’s profile in QuickBooks to set up automatic deductions and contributions. Then set them to be calculated “per hour worked.” Next time you hit “Run Payroll,” QuickBooks will automatically calculate the deductions or contributions for you.

Say hello to Shopify POS

If you’re a QuickBooks Desktop user, you might be using QuickBooks Point of Sale (POS) to track and categorize sales in your books. As of Oct. 3, 2023, Intuit won’t be updating QuickBooks POS.

In its place, Intuit has partnered with Shopify to create a seamlessly integrated POS solution. Our Certum Solutions team has been a big fan of Shopify for a while, so we fully endorse the QuickBooks-Shopify collaboration.

Shopify is offering some perks for current QuickBooks POS users making the change to Shopify POS, and we can help make sure you take advantage of all of them. Once you’re a Shopify POS user, you’ll have features such as remote access, enhanced reporting, and multi-channel selling.

It’s possible to keep using QuickBooks POS after October, but you’d lose both functionality and security over time. If making the transition to Shopify feels like one more laborious or time-consuming task on your list, the Certum team would be happy to assist you. While you’re at it, we suggest updating from QuickBooks Desktop to QuickBooks Online Advanced for a better experience and all the benefits of cloud computing.

Spring Into Action with Certum Solutions

This is a great time to play with building custom reports with easy-to-understand visualizations or to streamline your payroll process. It’s also the right time to spring into action on your point of service solution and any changes you’d like to make ahead of the October deadline. We’re happy to help you hop to it, so book time to talk with the Certum Solutions team to get started.

Image courtesy of Intuit QuickBooks