QuickBooks Online Advanced Gets Powerful Reporting Updates in March 2023

March comes in like a lion, roaring into action with a flurry of updates for QuickBooks Online Advanced®, QuickBooks Online®, and QuickBooks Payments.

I’m especially excited about the fleet of changes that make QuickBooks Online Advanced even better for creating, comparing, and sharing custom reports. If you’re planning to grow your business, these tools can help you make decisions by keeping the right data at your team’s fingertips.

Please reach out if you have questions about these updates, how they might be able to help your business, or how to get started with QuickBooks Online or QuickBooks Online Advanced. The Certum Solutions team and I are always happy to talk through solutions! Schedule a consult to connect with us.

QuickBooks Online Advanced Ups Its Reporting Game

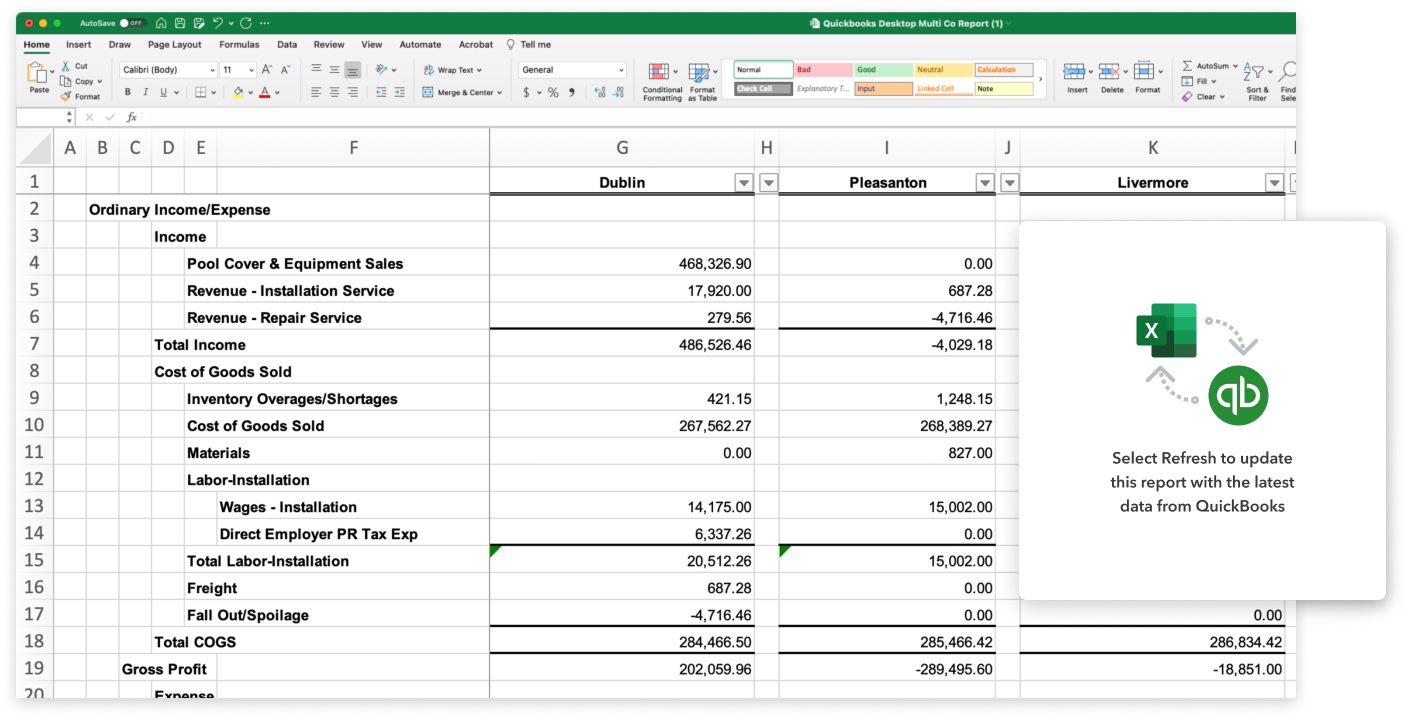

With a feature called Spreadsheet Sync, QuickBooks Online Advanced users can now generate reports for multiple companies or entities, then group them to create consolidated reports. Harness the power of Excel to slice and dice the data, including merged charts of accounts. Once you save your report, simply refresh to sync the latest data from across your business. For mid-sized or growing businesses with subsidiary companies, it’s a big step forward to get a more accurate picture of your overall business health.

QuickBooks Online Advanced has a Performance Center, Estimates vs. Actuals for Projects, and a Custom Report Builder that enable detailed tracking and data analysis. New this month to its custom reporting feature is the ability to set a schedule for QuickBooks to email standard and custom reports. Once scheduled, you can keep owners, investors, accountants, and other stakeholders in the loop on business performance without a second thought.

Next, the QuickBooks Online app now supports both Mac and Windows. The app is a fan favorite for businesses that have used QuickBooks Desktop, with a similar layout and user experience. Longtime QuickBooks Online users may also enjoy using the app to make it easier to stay signed in to QuickBooks or to juggle multiple companies’ accounts at once. To download the app, log in to your account in a web browser, click the gear icon, then hit "Get the desktop app."

Keep in mind, all the updates so far are only for QuickBooks Online Advanced users. If they’re features you’re interested in using for your business, let’s talk about whether an upgrade makes sense for you.

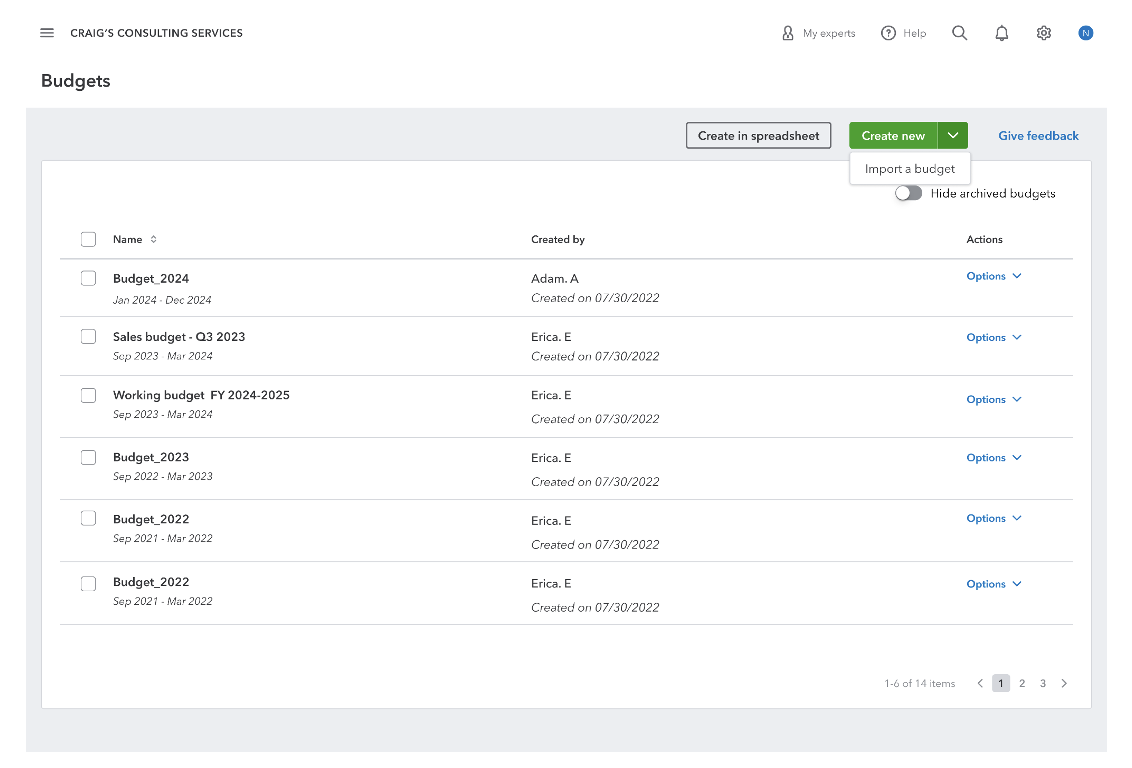

There’s one last change that’s coming soon, and it’s for both QuickBooks Online Advanced and QuickBooks Online Plus. Using data from your QuickBooks account, you’ll soon be able to build a budget within the program. Reports and comparisons with reference data allow you to track performance against your budget. With QuickBooks Online Advanced, you can use the Spreadsheet Sync feature to work with your data and budget reports in Excel.

QuickBooks Online Reduces Invoicing Friction

This update affects the entire QuickBooks Online family (Simple Start, Essentials, Plus, and Advanced). You can now set a recurring invoice for customers who get billed the same amount on a regular basis, whether that’s daily, weekly, monthly, or annually. The recurring invoices reduce friction in the payment process by automatically sending invoices on time, every time. Plus, customers can choose to automatically pay their invoices upon receipt.

QuickBooks Payments Has Your Back

There’s a trio of updates to make life a little easier for QuickBooks Online users who have QuickBooks Payments. First, a sigh of relief for business owners who frequently face chargebacks from credit card companies: QuickBooks Payments now offers dispute protection, meaning that chargebacks are automatically forgiven. QuickBooks charges a fee as low as 0.99% per card transaction; for that, you get chargeback protection up to $10,000 per transaction and up to $25,000 per year.

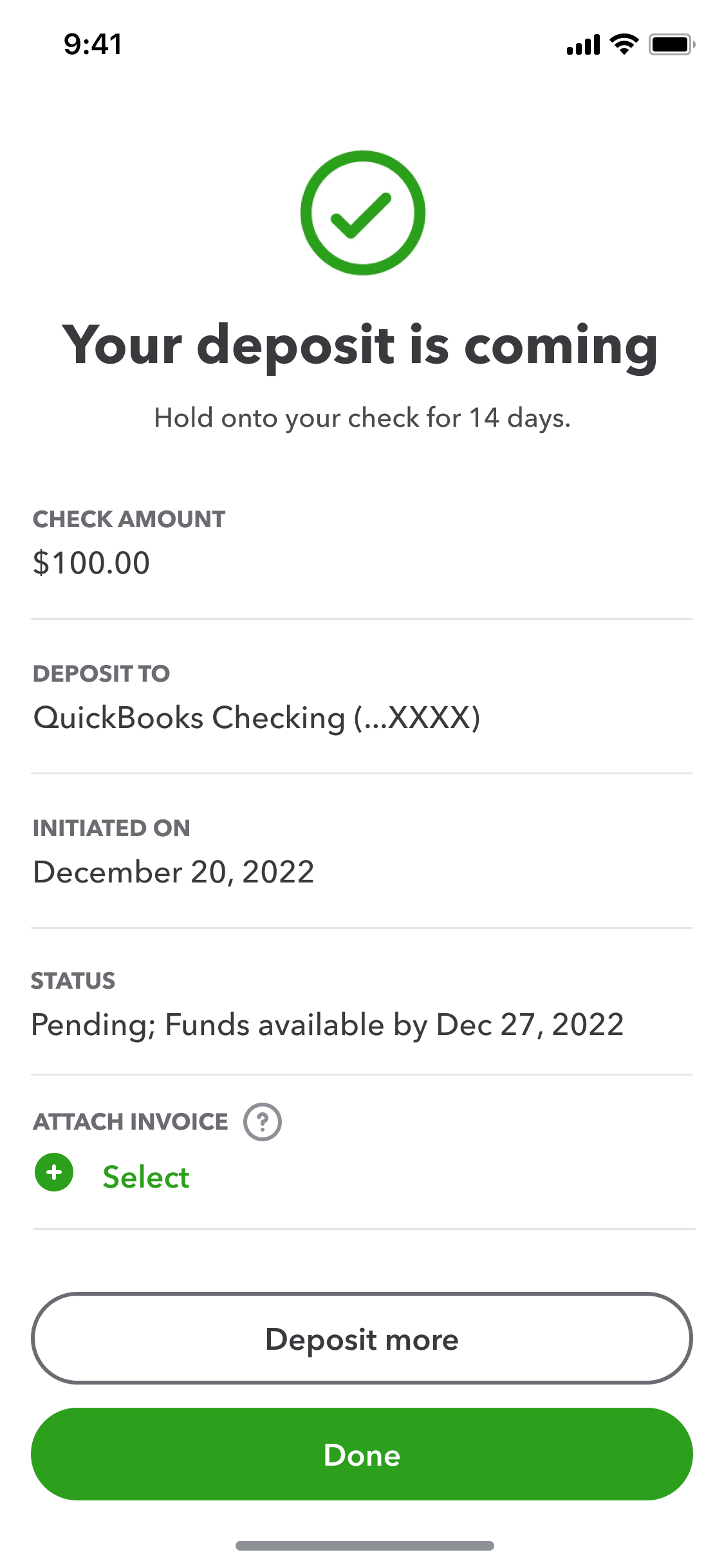

The final updates are for QuickBooks Payments customers who have also signed up for QuickBooks Checking. QuickBooks instant deposit is now available for any transaction you choose, without the long-term commitment. It’s free to receive up to $25,000 in deposits per day into your QuickBooks Checking account and a 1% charge to send it to another bank. You can also set up your bank account details once, then schedule automatic instant deposits.

You can also stay more organized through QuickBooks Checking by attaching invoices to check deposits. Payment reconciliation and accounting couldn’t be easier when the records are matched to each other from the time the check is deposited.

Power Your Business Growth with QuickBooks

The March 2023 updates to QuickBooks Online Advanced and QuickBooks Online underscore the ways you can power up your business growth with capable software. The Certum team is particularly excited about the reporting, planning, and budgeting functionalities in QuickBooks Online Advanced because of the way they put you in the driver’s seat with the right data for smart decision-making.

If you want to discuss the ways QuickBooks might help to power your business, book time to talk with the Certum Solutions team. We can help you find the right solution and get you set up for success.

Images courtesy of Intuit QuickBooks

From the QuickBooks legal team

QuickBooks Online app: The QuickBooks Online app for Windows and Mac (“app”) requires a Windows PC or Mac computer with a supported browser (see System Requirements for a list of supported browsers) and an Internet connection (high-speed recommended). The app is available for QuickBooks Desktop migrators with an active QuickBooks Online Simple Start, Essentials, Plus or Advanced subscription. Multiple company tabs allow for simultaneous sign in across multiple company files. Access to each company file sold separately. Terms and conditions, features, support, and services options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Subscription to QuickBooks Online is required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Payments Dispute Protection: Payments Dispute Protection ("PDP") is an additional service that covers you for certain payment disputes (i.e. "chargebacks") that your customer initiates through its card issuer associated with a credit or debit card transaction on the American Express, Discover, Mastercard or Visa networks and are processed by QuickBooks Payments while you are enrolled in PDP. Payment disputes covered by PDP are subject to a per-payment dispute coverage limit of $10,000 with a total annual coverage limit of $25,000 for all payment disputes received on a rolling 365-day period. Payment disputes related to transactions processed by QuickBooks Payments prior to 3 PM PT on your enrollment day will not be covered if you enrolled in PDP after 3 PM PT. The service fee for PDP ranges from .99% to 1.99% based on eligibility criteria. Terms, conditions, and service fee subject to change without notice.

Instant Deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, including delayed eligibility for new users and availability for only some transactions and financial institutions. The service carries a 1% fee in addition to standard rates for ACH, swiped, invoiced, and keyed card transactions. This 1% fee does not apply to payments deposited into a QuickBooks Checking account. Deposits are sent to the financial institution or debit card that you have selected to receive instant deposits. Scheduled instant deposits are run automatically; QuickBooks checks for eligible funds up to 5 times per day. Non-scheduled instant deposits are sent within 30 minutes. Transactions between 2:15 PM PT and 3:15 PM PT are excluded and processed next day. Deposit times may vary due to third-party delays.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation.

©2023 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.