Manage Your Workforce and Money with June’s QuickBooks Online Updates

Having a staff can be one of the most rewarding parts of running a small business — and one of the most stressful. The updates to QuickBooks Online this month take away some of the stress by making it simpler to manage, pay, and support employees.

Other big updates in June include an increase to $5 million in QuickBooks Checking and QuickBooks Money accounts that’s FDIC-insured, streamlined user management, and a new tax feature for solopreneurs.

New QuickBooks Workforce App Combines Time Tracking and Payroll

If you and your staff use the QuickBooks Time app to track time and manage projects, it’s about to get easier to integrate paydays through QuickBooks Payroll. By the end of the month, the QuickBooks Time app will relaunch as QuickBooks Workforce, seamlessly combining time tracking and payroll in one app, with just one secure sign-in.

Employees will be able to clock in and out, see their work schedule, view their recent paychecks, and check their time off balances in one place. For business owners, W-2s and payroll can easily be taken care of within the app.

Offer Employees Safe Harbor 401(k) Plans Through Guideline

Another win for employers with employees this month: QuickBooks Online has partnered with Guideline to make it easy to offer Safe Harbor 401(k) plans. 401(k) accounts are a smart way to save for retirement, and they’re a huge incentive to be able to offer as a small business.

The 401(k) offering comes at a great time. Because of the SECURE 2.0 Act, every business with at least 10 employees needs to automatically enroll them in a retirement savings plan, among other changes meant to help Americans save for retirement.

With a Safe Harbor plan, business owners are making contributions, which vest immediately, to every employee’s 401(k) account. That can give employers safe harbor against the IRS’s nondiscrimination tests, which are in place to ensure fairness at every level of a company.

There’s only two months to get signed up for a Guideline Safe Harbor 401(k) plan through QuickBooks for 2024. The Certum Solutions team would be glad to chat to help you decide whether it’s the right choice for your business and meet the Aug. 23 deadline for signup.

Cash in QuickBooks Checking and QuickBooks Money is FDIC-Insured up to $5M

Has the fallout from Silicon Valley Bank and the ripple effects across the banking industry had you nervous about your money? QuickBooks and its banking services partner, Green Dot Bank, are giving users some peace of mind with a change to its FDIC-insured balances and Deposit Sweep Program.

With a balance in a QuickBooks Checking and QuickBooks Money account of more than $250,000, the funds are now FDIC-insured up to $5 million. For any amounts over $250,000 in an account at the end of the business day, Green Dot Bank sweeps balances to spread them across other participating financial institutions to provide customers with the higher FDIC insurance coverage.

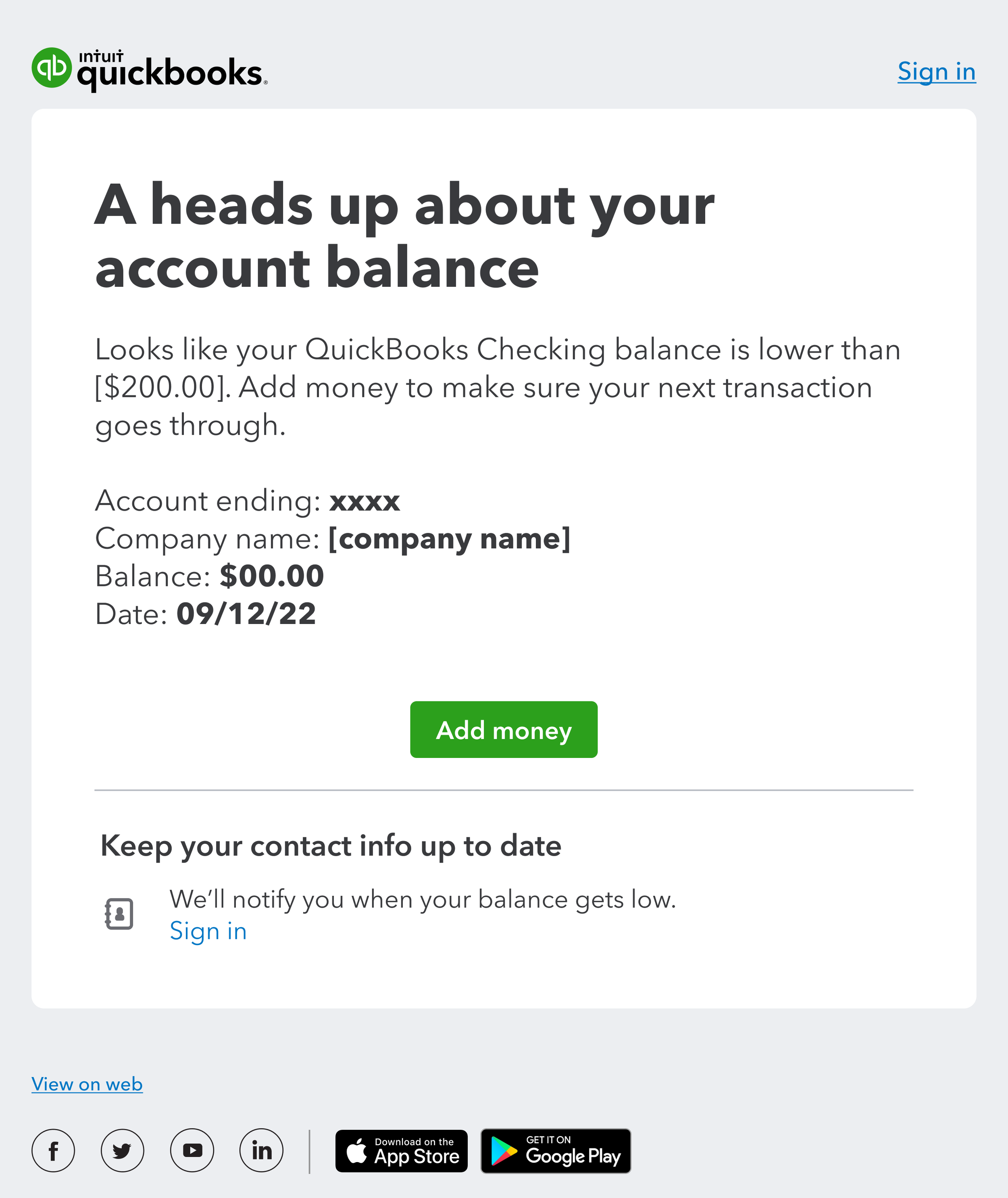

And in another move to help you stay on top of your money, QuickBooks Checking now offers email and push notifications for critical issues, such as a balance below $200, insufficient funds for a purchase, or too many failed PIN attempts. The notifications provide next steps, to help you resolve any issues.

Manage QuickBooks Online Users and Roles in Fewer Clicks

If you have QuickBooks Online Advanced, you may have already noticed that the tabs to add QuickBooks users and to assign roles to those users have been combined. For everyone else, a single page to add and update users and their roles within QuickBooks is coming by the end of July.

We love how easy this makes it to manage users at a glance, especially in QuickBooks Online Advanced, which has a nice grid view to easily customize access to different features.

Sole Proprietors Get Tax Tips in the QuickBooks Mobile App

If your business doesn’t have employees, don’t worry! There’s a QuickBooks Online update just for you this month, too. If you’ve indicated that you’re self-employed, then you’ll now see a tax module when you use the QuickBooks app on a mobile device.

It’s chock-full of tips, insights, and action items that can help you with categorizing transactions, possible tax deductions, and estimates for quarterly and annual taxes. The tools in the tax module are designed to help you feel confident about your taxes and profits.

Relax More, Stress Less with June’s QBO Updates

Give yourself a break by taking advantage of these newly released features in QuickBooks so you and your employees can feel less stressed — and have more time for summer fun. The workforce and 401(k) updates are particularly exciting for small businesses with a staff.

If this summer is the right time for you to migrate to QuickBooks Online or QuickBooks Online Advanced, we’d love to support you with a discount and personalized service. Just book time to talk with the team at Certum Solutions.

Images courtesy of Intuit QuickBooks