3 Sets of QuickBooks Online Updates to Launch into Summer

Get ready to slide into summer with a handful of updates to QuickBooks Online® that help with business efficiency and management.

The Intuit team has spiffed up a couple features in QuickBooks Online Advanced®, including a much-requested addition to custom reports. Just in time for the influx of part-time summer gigs, there’s a trio of changes that ease some of the burdens of managing employees and contractors. And for those contemplating a software migration involving QuickBooks Payments, the road has gotten a little smoother. In all, these three sets of QuickBooks updates can help you launch into summer fun with a little less stress.

QuickBooks Online Advanced Updates

1. Workflows Get Multiple Conditions and a Visualization

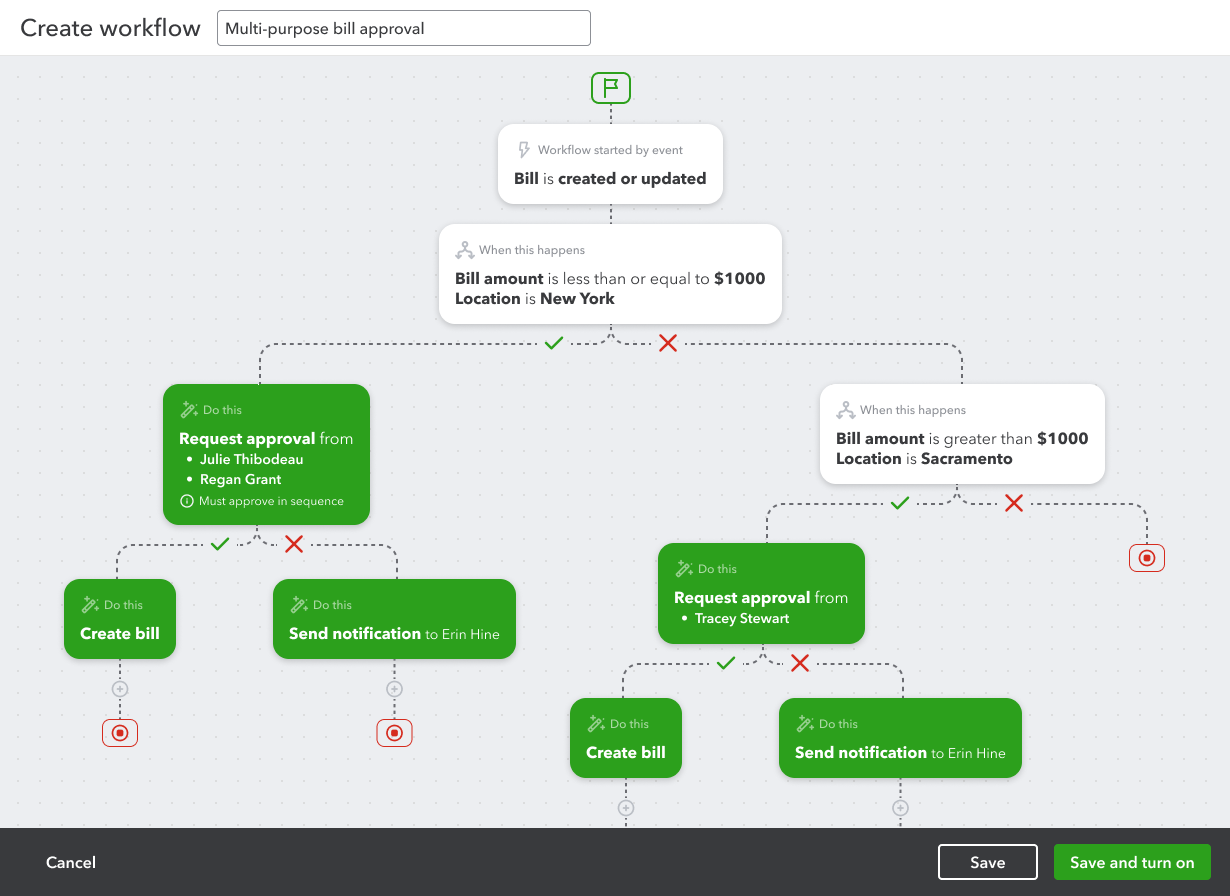

For users of QuickBooks Online Advanced, invoice-approval workflows can now be better automated and customized to complement your approval process. This new feature enables you to incorporate multiple conditions when creating an invoice-approval workflow. For example, you can include rules for routing invoices based on dollar amount or location.

For those of us who love charts and images to support words on a page, QuickBooks also added a new tool to create procedures. With the visual workflow builder, each step in the process — and any branching for multi-conditional approvals — is charted out so you can design your workflow with accuracy. It's important to note that if you begin creating a workflow with the visual workflow builder, you can’t toggle to the other interface.

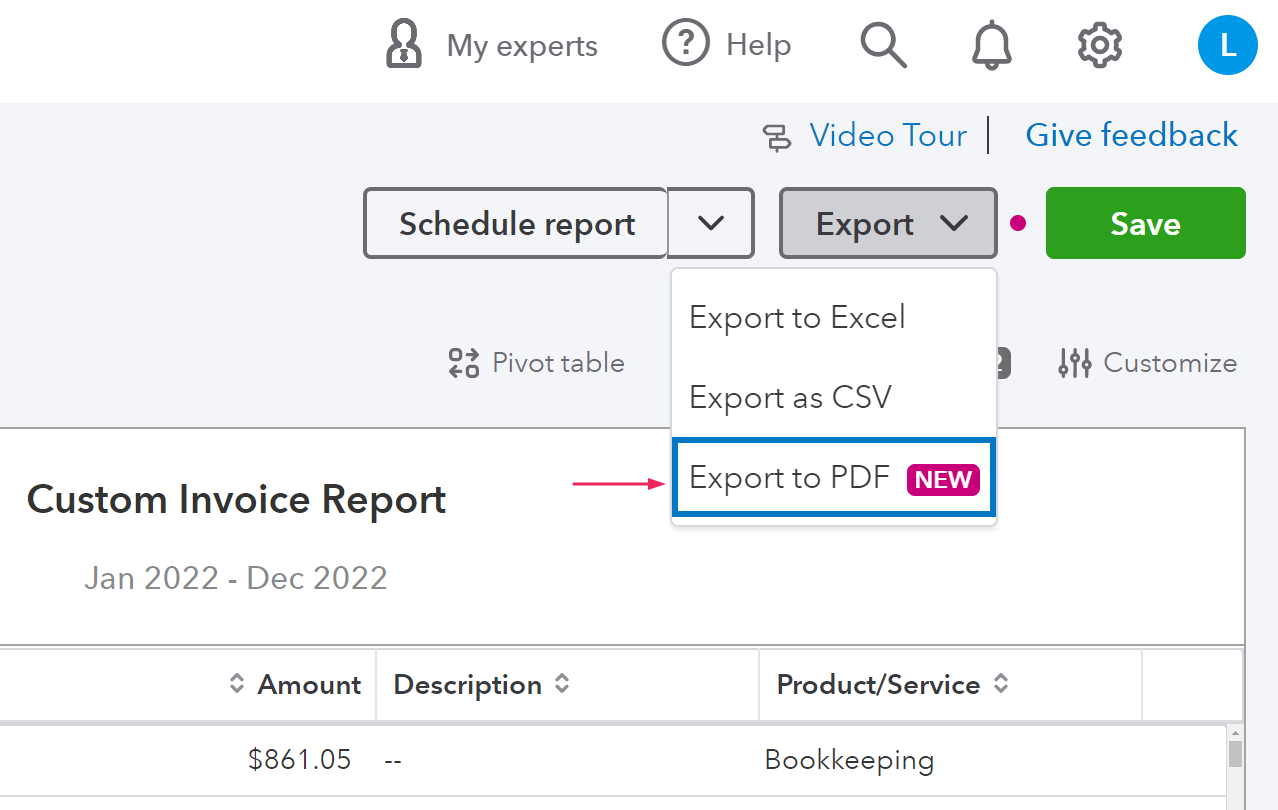

2. Download Custom Reports as PDFs

QuickBooks Online Advanced now allows you to export PDFs directly from the Custom Report Builder. This highly requested feature saves you time — getting a neatly formatted, shareable document is no longer a multi-step process. Just select “Export to PDF” in the Export dropdown to download your custom report.

This update brings users up to three options for exporting their custom reports: as a CSV file, as an XLSX file, or as a PDF.

Trio of Updates to Manage Workers More Easily

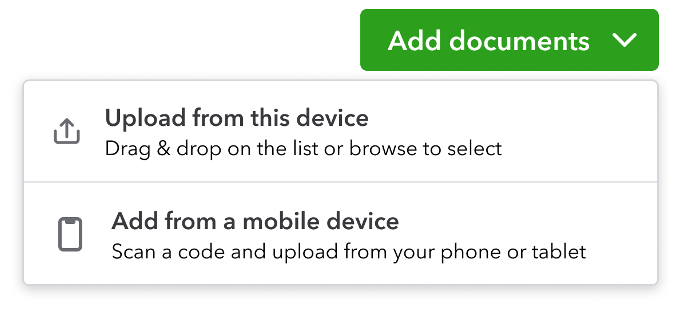

1. Keep Employee Documents in QuickBooks

Maintaining HR records and employee information can be a logistical challenge. Ditch the paper records and the folder of scanned documents on your desktop for a secure and streamlined worker management process. QuickBooks Online Payroll now includes a secure document management feature that lets you store and maintain documents like contracts, IRS paperwork, and other employee information in their profiles. Create folders to keep documents organized any way you’d like.

To get started, log in to QuickBooks Online Payroll, select the employee whose documents you want to upload, and follow the on-screen prompts to add their documents.

2. Track Contractors' W-9 Status

QuickBooks has made it easier for you to keep track of contractors' W-9 information when in the onboarding process. Business owners can now see at a glance which W-9 information is ready, missing, or requested. This makes it easier to ensure that you’re staying compliant with the IRS requirements for contractors.

If a W-9 is missing or requested, you can send an invitation or reminder to your contractor to provide this information. It will prompt them to finish filling out the form, so they can get paid.

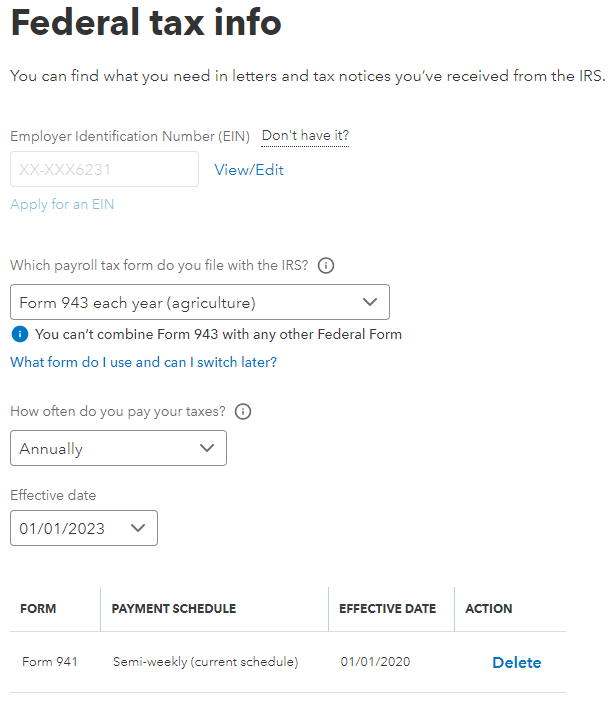

3. 943 Filing for Agricultural Employees

Agricultural businesses can now rely on QuickBooks Online Payroll to file Form 943, the Employer's Annual Federal Tax Return for Agricultural Employees.

This update allows you to file Form 943 directly within QuickBooks, so you don’t have to file manually or use a third-party solution. Existing QuickBooks Online Payroll customers can switch their filing status to 943 by selecting Payroll Settings and selecting the correct form in the Federal Tax Info section.

Software Migration Update

It’s smooth sailing for QuickBooks Desktop Payments users migrating to QuickBooks Online Payments. The latest update eliminates the need to call customer care or take manual steps to activate or relink your account. Instead, your payments account will automatically be activated and ready for you.

Your QuickBooks Online Payments account will have the same settings, preferences, and pricing as your original account, with a new merchant ID. You can process payments in both systems after migrating, until you choose to close your QuickBooks Desktop merchant account. Until you close your QuickBooks Desktop account, record payments in both systems because payments received in one are not automatically recorded in the other.

Use QuickBooks Online Payments to recreate any invoices awaiting payment in QuickBooks Desktop; those invoices will no longer be payable through QuickBooks Desktop once your account is closed.

Less Worry, More Fun with QuickBooks Updates

These updates to QuickBooks Online Advanced features, worker management, and QuickBooks Online migration are little ways to make your business operations more efficient. If you’d like a hand learning about or implementing any of the updates, we’d be happy to help. And if this is the right time for you to migrate to QuickBooks Online or QuickBooks Online Advanced, we’d love to hook you up with a discount and personalized service. Just book time to talk with the Certum Solutions team.

Images courtesy of Intuit QuickBooks