A Garden of Delights for May: New Features in QuickBooks

We’ve unpacked this month’s updates in all-things QuickBooks and found a virtual garden of delights for you and your business. Several of the updates focus on getting paid faster and mor efficiently; who wouldn’t want to have that happen?

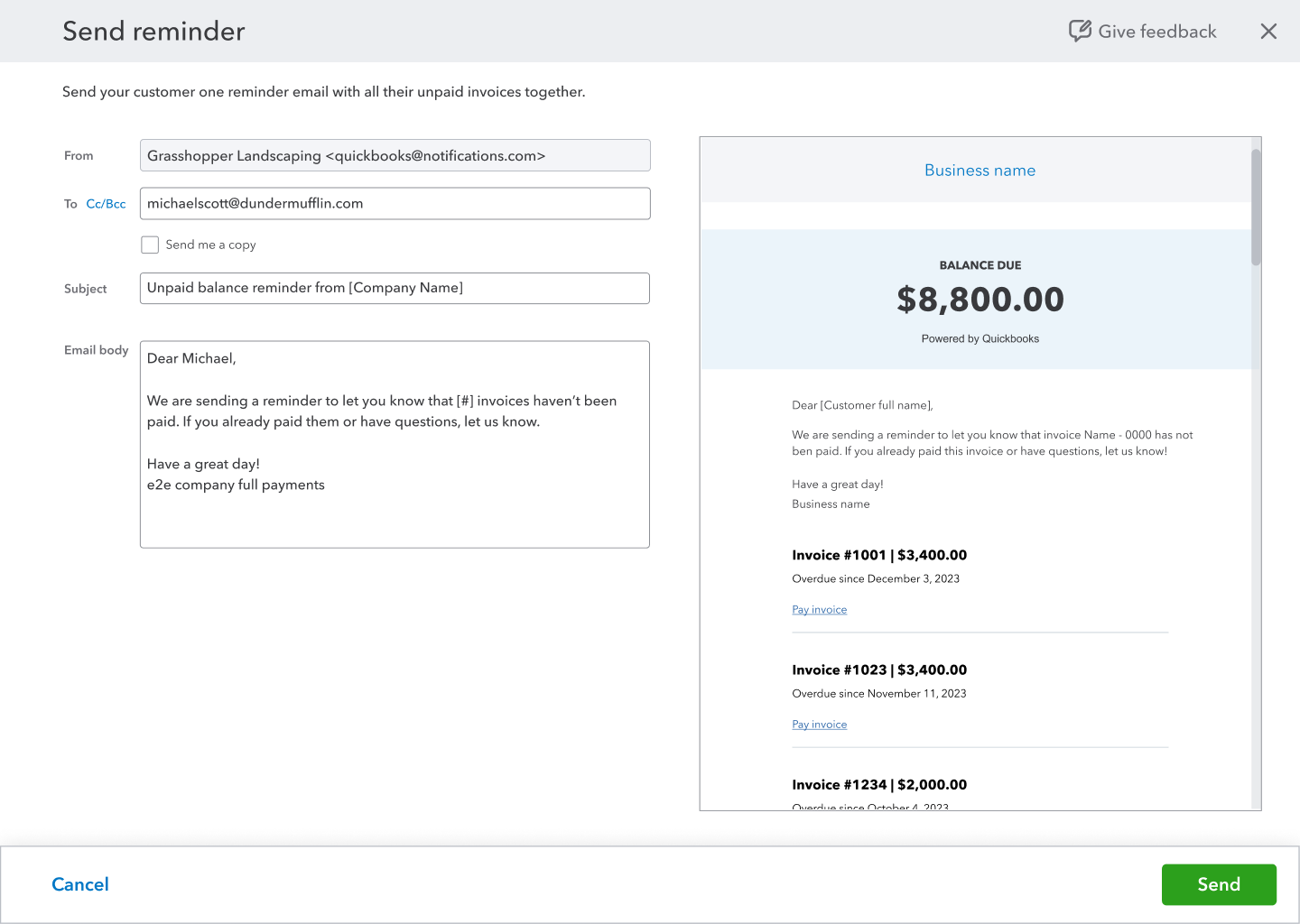

Get Invoice Reminders on Unpaid Balances in QuickBooks

No one wants to chase down a customer to pay their bills, but sometimes a reminder is needed. Previously, customers would receive separate email reminders for each invoice, making it difficult for them to locate them and remember to pay. Now, you can send an email reminder that totals their unpaid balances. This makes it easy to pay them all at once.

To send a grouped reminder to a customer:

Select Sales, then Customers.

In the Action column for your customer, select Send reminder.

Follow the steps to send a reminder to your customer about all their pending invoices.

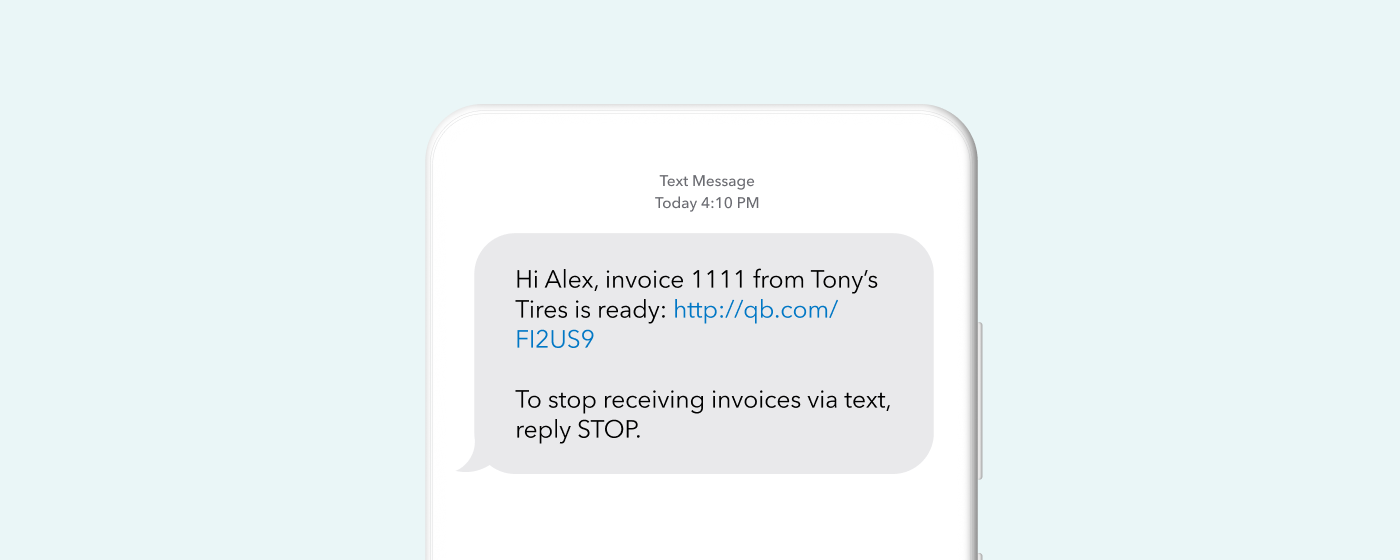

Send Invoices Over Text

If you use QuickBooks Payments, you can send invoices to your customers through text messages—in addition to email, which is probably the means you’ve been using up to this point. Sending a reminder over text helps make your customer more aware of what they owe and can also make it easier for them to pay you.

To access this feature, you must send pay-enabled invoices as a U.S.-based Payments merchant on the Rethink platform. After selecting Review and Send in your invoice, you can select the option to Add text message. From there, you can preview the text message and add your customer’s mobile phone number as needed. Then, click Send invoice to send both the email and text invoice to your customer.

As always, be sure you have permission from your customer before sending an invoice by text—and they can opt out of messaging anytime they want. Asking for permission also creates a great touch point for you to contact your customers and have a conversation with them about how their business is doing.

No Need for a Manual Process: Batch Import Journal Entries

Just ask you’re accounting or bookkeeping staff about manual entry … and you’re likely to get some “groans.” Now, one of the newest featured in QuickBooks Online is the ability to batch import journal entries from a .CSV file. Staff can upload journal entries rather than type them. This helps ensure consistency and accuracy of your financial data. Contact us and we can show you how to get this done.

Create Item and Sales Receipt Transactions From Bank Feeds

Bank feeds are important in QuickBooks Online for several reasons. First, they verify your transactions more adequately by matching up to your entries and/or asking for approvals for transactions. They also give you a heads up in case there is fraud on your account by looking at downloaded transactions and ensuring they are all legitimate.

Also important are the insights you can gain from QuickBooks. A new feature now enables you to create transactions straight from your bank feed to help improve reporting and insights on your business performance.

You can now add transactions to the books at a more detailed item level, and also . add transactions as Sales Receipts to categorize them more accurately. Plus, for the purposes of creating an Estimates vs. Actuals report in QuickBooks Online Advanced, you can split transactions from the bank feed by product or service.

Digitize the I-9 employment verification process with QuickBooks Online Payroll (h2)

If you have QuickBooks Online Payroll Premium and Elite, can now collaborate more easily with your employees to complete I-9 employment verification. Rather than rely on hard copies of this important form, you can do the following:

As part of their QuickBooks Workforce self-setup, your new employee will fill out their portion to confirm their identity and eligibility for U.S. employment.

On their start date, the employee would bring you their ID-confirming documents.

Within 3 days of this start date, you would complete the employer part of the I-9 form in QuickBooks.

The employee’s I-9 is stored in the Documents tab of their profile.

Note: QuickBooks Workforce must be enabled for an employee for them to self-setup and complete their I-9 form. Certum can show you how to do this.

Reach Out to Certum Solutions

At Certum, we’re here to help you scale gracefully by helping you be more productive. We want you to spend time devoted to growing your business rather than chasing down the details in accounting and bookkeeping. If you’re not already a client, reach out to us to schedule a free consultation.

Images courtesy of QuickBooks